« involving kids in research | Main | a class on geography & obesity »

August 13, 2003

the budget

A lot of people’s eyes glaze over when they hear about a “budget”—whether it’s for a business, a club, or the government of the United States. Yet the government has enormous influence on our lives because of the way it collects our money and spends it for various purposes. Its spending priorities are reflected in its budget.

Unless you understand roughly what the budget includes, your opinions may be completely irrelevant. For example, according to an excellent survey by the Program on International Policy Attitudes (PIPA), a majority of Americans believe that the US spends too much money on foreign aid. They estimate that 20 percent of the federal budget goes to foreign aid; they would reduce this amount to 5 percent. In fact, the federal government devotes less than 1 percent of its budget to foreign, nonmilitary aid. Anyone who calls for aid to be cut to 5 percent has an irrelevant opinion, because he or she doesn’t understand what the government does.

Here, then, is how the federal government spent an average tax dollar during the years 1998-2004 (2003-4 are estimated). The data come from this OMB document, but I have made decisions about what programs to put in each category. The federal government is responsible for about two-thirds of all taxation, although it gives some of its funds to states. States and local governments together raise about one third of all taxes. (Source: OMB.)

The "all other" slice in the chart above is distributed as follows:

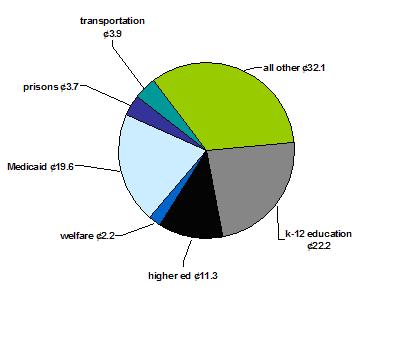

Here is how an average state tax dollar is spent. Data from National Association of State Budget Officers, State Expenditure Report, 2001 (Summer, 2002).

And this is an average county budget from 1996-7, based on the US Census Bureau’s survey of county officials

Posted by peterlevine at August 13, 2003 12:23 PM